The ESNI Community has the pleasure to invite you to the fifth edition of the ESNI Conference ‘ Growing the future of nutrient recycling’.

The event on nutrient recovery and recycling will take place on Wednesday 18 and Thursday 19 September 2024 at Ateliers des Tanneurs, Brussels (BE).

As every year, the conference will bring together leading experts in the field of nutrient recycling to foster collaboration among European entities engaged in nutrient recycling, exchanging valuable experiences and identifying knowledge gaps to guide future research.

What to expect from this edition?

- 1 day and a half of high-quality talks on nutrient recycling with policy-makers, industry and researchers;

- 9 parallel interactive sessions showcasing the technological, economic and social benefits of nutrient recycling and reuse;

- Participation of more than 160 people coming from the bio-based resource recovery sector all over Europe;

- Great networking opportunities to exchange ideas and build up new synergies;

- Poster session displaying new researches from EU-funded projects.

Programme and registration here.

Currently operating 38 biomethane plants across France, the UK, and the Netherlands, ENGIE aims to ramp up production significantly with ambitious plans to reach 10 TWh by 2030. With a dedicated investment budget of 3 billion euros, ENGIE is committed to reducing Europe’s carbon footprint and enhancing energy resilience. We spoke with Annette Kroll, Head of Regulation & Advocacy at ENGIE, about ENGIE’s biomethane activities and ambitions for the renewable gas sector.

Introduction of ENGIE

ENGIE is a global reference in low-carbon energy and services, striving daily to accelerate the transition towards a carbon-neutral economy through reduced energy consumption and more environmentally friendly solutions. ENGIE is committed to achieving Net Zero Carbon by 2045 across all three scopes. Our strategy is underpinned by a vision: the alliance of the electron and the molecule. To implement this vision, ENGIE has earmarked growth investment of 22 to 25 billion euros for 2023-2025, to be allocated to renewables power, energy solutions, the development of renewable gases, and battery storage projects.

Tell us more about the new business unit ENGIE just launched. Why is it important?

We launched our new business unit, “ENGIE Renewable Gases Europe”, about one year ago to consolidate all renewable gas activities into a single managerial entity. This milestone significantly strengthens our ambitions to develop green gases. The entity focuses on biomethane from anaerobic digestion but also covers new technologies.

Today, we own and operate 38 biomethane plants in France, the UK and the Netherlands, with a total production capacity of more than 1 TWh. Additionally, we are developing our “Salamandre” project in the port of Le Havre, which aims to industrialise a new production technology for renewable gas through the gasification of solid feedstocks.

How is ENGIE ensuring the sustainability of its biomethane production processes?

The environmental, social, and economic sustainability of our projects is a key concern for us. We place great emphasis on partnerships and the involvement of local communities, including the local population, local authorities, the agricultural ecosystem, and local industrials.

We have more than 500 farmers as partners and recently launched a survey to allow them to evaluate our cooperation in France. The outcome shows great satisfaction, which was a pleasant surprise, as industrial players are sometimes viewed with skepticism in rural environments. 70% of our farmer partners said they would engage with ENGIE again. Those who would not re-engage cited various reasons, such as planning to retire soon.

In terms of environmental sustainability, our larger plants are all RED-certified. Currently, we predominantly use waste from agriculture, the agri-food industry, and municipalities. We have committed to ensuring that the share of food and feed crops remains minimal (not exceeding a 1-digit percentage) as we expand our capacities and enter new countries. Finally, we work with farmers to enhance sustainable farming practices, such as returning nutrients to the soil via digestate and implementing intermediary cropping.

What are ENGIE’s ambitions for biomethane in the mid-term?

We aim to achieve a production capacity of 10 TWh by 2030 in Europe and have dedicated an investment budget of 3 billion euros to this goal.

Why are we doing this? Because we are convinced that biomethane can make a substantial contribution to Europe’s decarbonisation and renewable energy targets. It will also help to create a more resilient energy system, reducing dependency on imports and enhancing the system integration of variable renewable power sources. We firmly believe in the complementarity of green electrons and green molecules.

In the next legislature, climate regulations will be revised. What topics would you like policymakers to discuss?

One of the debates in the next legislative term will be Europe’s 2040 decarbonisation target. We hope that the contribution of biomethane will be properly taken into account. This is an opportunity to introduce more specific and effective target(s) underpinned by market-based mechanisms to promote biomethane and other renewable gases. Strong targets are important to create long-term visibility for our sector.

Moreover, there remains work to be done to fully implement a European market for biomethane and remove technical and political barriers. Non-EU countries like the UK and Ukraine should also be connected and able to trade in this market.

Finally, we see topics “beyond energy” that need to be discussed at European level. How can we mobilise additional feedstock such as intermediary crops? What is the right framework to better valorise by-products such as biogenic CO2 and digestate?

We count on such discussions to happen with a pragmatic, market-friendly, and technology-open mindset.

Members-only event

Join us for the launch webinar of the EBA Biogas Manual on 3 September from 10:00 to 10:45!

The biogases industry crosscuts many different sectors, from agriculture and waste management to heating and transport, to mention a few of them. All these sectors have specific European legislation that applies to them. Understanding this complex EU regulatory framework is prerequisite to a successful biogas or biomethane project.

At EBA we help you to overcome this challenge by keeping track and informing you about EU policy developments. Now, we are taking this task to a new level by publishing a first-ever, members-only Manual on applicable EU legislation and standards for the sector.

Examples of questions covered in the Biogases Manual:

- What does the EU law state about the use of agricultural feedstock?

- What sustainability criteria should I apply to my new production project?

- Are there any requirements for the storage of digestate?

- How does the EU incentivise the use of biomethane in transport?

- How can the EU support financially my projects?

- ..and many others on financing, heating, transport, procurement.

Whether you are a regulatory expert or a business developer unfamiliar with the EU complexities, the Biogases Manual will provide you with comprehensive insights into the legislative landscape.

Agenda

Welcome and introductory remarks – Giulia Cancian (EBA Secretary General)

The Biogas Manual: How to use it – Anthony Lorin (EBA Senior Policy Analyst)

Glimpse into the 8 Chapters of the Manual – Florence Goarin (EBA Policy Officer), Lucile Sever (EBA Policy Officer), Anthony Lorin (EBA Senior Policy Analyst), Anna Venturini (EBA Policy Manager)

Q&A – EBA Policy team

Climate change exacerbates water stress: from unpredictable rainfall patterns to shrinking ice sheets, most impacts of climate change come down to water and the disruptions in the water cycle could profoundly alter how we live our lives. The biogases value chain, closely linked with water cycles, offers solutions on multiple fronts: it supports wastewater recovery and water purification, enhances soil health, and provides a new source of water for irrigation.

Climate change increases the likelihood of droughts and makes them more severe and prolonged. Rising temperatures modify precipitation patterns and affect snowpacks and glaciers, which act as natural water reservoirs by releasing water slowly over time. This leads to drought and water stress, significantly impacting agriculture and, more broadly, soil health. Today, 60 to 70% of European soils are unhealthy[1] due to climate change.

A holistic approach to address water stress as a critical part of climate change mitigation is essential. The whole European bioeconomy, including the biogases value chain, will need to assess their efforts to tackle this global challenge.

Enhancing water circularity and resilience with biogases

Water circularity is integral to the biogas value chain. Municipal wastewater (sewage sludge) and industrial wastewater can be used as feedstock for biogas production via a water purification process. In municipal wastewater treatment, biogas is generated from the remaining sewage sludge after water purification. In industrial wastewater treatment, an additional step enables the production of biogas using wastewater as feedstock. This reduces the waste load and the need for the following energy-intensive purification processes.

Biogas plants can also address water stress: digestate, used as an organic fertiliser, increases the organic matter in soils, improving their water retention and resilience. Additionally, advanced cleaning technologies, such as innovative combinations of ultrafiltration (UF) and reverse osmosis (RO),allow pioneering plants to produce clean water from digestate, which can be used for industrial processes, maintenance of green areas, or agriculture, further alleviating water stress. Many biogas plants recycle also the digestate to reduce on-site water consumption.

A water strategy to boost water resilience and sustainability

On the 17th of June 2024, the Council of the European Union highlighted “the important regulating role of water cycles for ecosystems, human life and the functioning of the economy and our society” in its conclusions on the mid-term review of the 8th Environmental Action Programme. To ensure the preservation of this vital role, a comprehensive Water Resilience Initiative is essential and long overdue. The strategic initiative should ensure the benefits of biogas plants are fully utilised, including the use of clean water from digestate for various applications and the valorisation of the digestate itself to enhance soil properties. An integrated EU approach to water, which could incorporate water-related criteria into energy policies, would help enhance water resilience and sustainability.

Besides, green waters, held in soil and available to plants, are crucial for agricultural resilience. EU policies should reward agronomic practices that enhance water retention, such as using digestate or implementing sequential cropping as feedstock for biogas production. A higher focus on innovative water-saving technologies in biogas plants would also help address water resilience and sustainability challenges.

The European Biogas Association (EBA) actively participates in the European Commission’s Research and Innovation program. EBA is a partner in the FER-PLAY project and has also participated in the SYSTEMIC and Nutri2Cycle projects. These initiatives aim to advance technology and knowledge sharing, particularly in upgrading and applying digestate, which ultimately contributes to boosting water resilience and sustainability.

EBA is also a member of the Water Resilience Coalition, a group of 30 organisations dedicated to prioritising water issues in the new European Commission mandate.

About the authors

Lucile Sever – Policy Officer sever@europeanbiogas.eu

Mieke Decorte – Technical Director decorte@europeanbiogas.eu

[1] Commission Staff Working Document accompanying the EU soil strategy for 2030 of 17 November 2021 SWD(2021)323 final.

Published on 11 July 2024

Brussels 05/07/24 – Europe has reached an installed capacity of 6.4 billion cubic meters (bcm) of biomethane per year, according to the European Biomethane Map released today. 81% of the capacity corresponds to plants located in the European Union (5.2 bcm). The EU-27 countries’ growth has reached 37%, while the capacity of the non-EU countries analysed grew by 20% compared to the 2022-2023 dataset.

The total installed capacity of European biomethane can contribute to avoid nearly 29 million tons of CO2 emissions annually and produce 830,000 tons of organic fertiliser per year. These plants can also provide renewable energy to 5 million European households throughout the year, or fuel 145,000 bio-LNG year-round, delivering Europe’s long-term energy security and climate mitigation objectives.

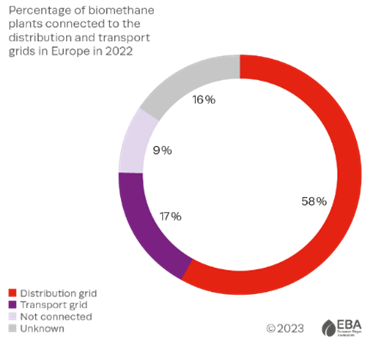

The map features 1,548 biomethane plants. This represents a 32% growth in the number of plants in Europe compared to the previous edition, which featured 1,174 units. Over 80% of the reported biomethane plants are now connected to the gas grid, with nearly half of them (49%) connected to the distribution grid and 14% to the transportation grid.

France is one of the countries leading the biomethane scaleup pathway and has nearly doubled its capacity compared to the previous edition of this map. Italy has also shown significant growth, increasing its number of plants four-fold and its total plant capacity more than threefold, while the United Kingdom and Denmark maintain their positions among the top five biomethane producers in Europe. Germany remains the biggest biomethane producer, but has paused the construction of new plants.

The momentum in the biomethane sector aligns closely with the 2030 objectives set forth in the REPowerEU plan. €25 billion in private investments have been so far secured by 2030 and this will result in the installation of 950 new biomethane plants, as reported in recent analysis by the European Biogas Association.

“The 2024 Biomethane Map highlights the significant growth of the biomethane sector, demonstrating industry’s determination in achieving the REPowerEU targets. To sustain this progress, it is crucial for EU member states to identify clear targets and pathways and for the EU itself to support the sector with long-term policies and administrative simplification for operators. This commitment will ensure a robust and resilient energy transition across Europe.” – Giulia Cancian, EBA Secretary General

The European Biomethane Map is an annual publication by the European Biogas Association (EBA) which this year includes for the first time an open-access interactive map, built with the support of EBA members, who have provided the necessary data. Additionally, the digital and print versions of the European Biomethane Map are the result of an ongoing collaboration between the EBA and Gas Infrastructure Europe (GIE). Sources of each country are listed on the map. Data covers active facilities under operation, according to the available EBA dataset by June 2024.

‘’This 5th edition illustrates that biomethane is today’s green solution. Gas infrastructure operators welcome this 37% increase and will keep bolstering its development. Natural gas and biomethane’s synergies are invaluable at technical, economic and policy levels. This makes this renewable gas fit for today’s gas infrastructure and for our clients. With supportive policies and collective efforts, we can help sectors decarbonise quickly and cost-effectively while avoiding stranded assets.’’ – Pierre Duvieusart, GIE Biomethane Area Sponsor & GIE Board Member.

Contact

Anastasiya Agapova – EBA Technical and Projects Officer agapova@europeanbiogas.eu

The European Biomethane Map is an annual publication by the European Biogas Association (EBA) which this year includes for the first time an open-access interactive map, built with the support of EBA members, who have provided the necessary data. Additionally, the digital and print versions of the European Biomethane Map are the result of an ongoing collaboration between the EBA and Gas Infrastructure Europe (GIE). Sources of each country are listed on the map. Data covers active facilities under operation, according to the available EBA dataset by June 2024.

Discover the interactive version of the European Biomethane Map 2024

How are biogases produced and utilised, and what are their main benefits for the environment, society, and energy landscape? Explore our publication ‘Decoding Biogases: Made in Europe, Sustainable, and Affordable’ for insights.

Key highlights include:

- Biogases: the all-rounders of the future energy mix

- Latest data on biogases production in Europe

- Facilitating a resilient energy transition

- Decarbonising the EU economy with biogases

- Valorising digestate and bio-CO2

- Enabling a negative emissions footprint

- Socio-economic benefits across the biogases value chain

Interested in learning more about biogas and biomethane production and use across Europe? Check out the EBA Statistical Report here.

EBA monitors biomethane investments yearly to forecast the growth of the sector and better identify market trends, drivers and gaps.

The second biomethane investment outlook identifies a growing commitment from industry with a total of 27 billion EUR allocated to invest in biomethane production. This marks a growth of 9 billion EUR compared to investments identified one year ago. The figures presented in this outlook are based on replies from 26 investors and project developers within the EBA, 2 more compared to the previous edition. The investments are projected to deliver 6.3 bcm/year of biomethane capacity to Europe by 2030.

Brussels 18/06/24 – The European biomethane sector will receive an injection of €25 billion in private investments by 2030, according to a European Biogas Association (EBA) analysis released today. This represents a 30% increase compared to last year estimates. The 2nd edition of the Biomethane Investments Outlook forecasts €2.1 extra billion investments in the pipeline, but yet to be allocated.

The projected investments by 2030 will result in the installation of 950 new biomethane plants across Europe, alongside the 1,300 facilities already operational. This will add 6.3 billion cubic meters (bcm) of biomethane capacity annually to the continent, which could contribute to avoiding nearly 29 million tons of CO2 emissions each year, providing renewable energy to 5 million European households year-round, and producing 830 thousand tons of fertiliser annually.

Investments will be mostly located in Denmark (€3.6 billion), Poland (€3.4 billion) and Italy (€2.4 billion). In the case of Denmark, the share of biomethane in the gas grid is close to 40% and there are plans to increase this production to substitute 100% of the gas demand before 2030.

Two years following the launch the REPowerEU plan, the industry is swiftly mobilising to achieve the 35 bcm biomethane production target by 2030. Investments are crucial to fully unlock biomethane production potential and streamlining the development of new plants across Europe.

Aligning the EU Taxonomy with the REPowerEU objectives for biomethane will direct capital towards the sector. The EU Taxonomy plays a crucial role in incentivising green investments, although challenges in implementing screening criteria persist. To secure the announced investments, it is essential to implement aligned policies, maintain stable regulatory frameworks and facilitate long-term end-use of biomethane and its co-products.

EBA will present the key outcomes of this analysis on 5th July at the webinar “Biomethane scale-up in figures: Mapping new plants and investments across Europe”, which will also unveil the new edition of the European Biomethane Map.

Contact

Mieke Decorte – EBA Technical Director decorte@europeanbiogas.eu

We are delighted to invite you to the fourth European Biogas Association Dig Deep! Webinar “Biomethane scale-up in figures: Mapping new plants and investments across Europe”, on July 5, from 10:00 to 11:30, disclosing the most recent data on biomethane production facilities in operation and the private investment currently driving the growth of the sector with the launch of a new edition of the European Biomethane Map and the EBA Biomethane Investment Outlook.

2024 marks the second anniversary of the REPowerEU plan, an initiative that has seen rapid mobilisation within the industry to meet the ambitious goal of producing 35 bcm of biomethane annually by 2030. With an estimated total biomethane potential of 41 bcm by 2030, the sector is set for significant growth.

Investments are crucial to fully unlock biomethane production potential, streamlining the development of new plants across Europe, the decarbonisation of existing gas infrastructure and the integration of innovative technologies.

We look forward to discussing together the future of biomethane in Europe and exploring the opportunities for further investment and growth.

Programme

- 10:00 – 10:05 Welcome

- 10:05 – 10:15 Keynote

Phd Biljana Kulisic, Policy Officer, Unit C2 Decarbonisation and sustainability of energy sources, Directorate-General for Energy, European Commission

- 10:15 – 10:25 2nd EBA Biomethane Investment Outlook

Mieke Decorte, Technical Director, European Biogas Association

- 10:25 – 10:35 ENGIE’s biomethane portfolio

Annette Kroll, Head of Regulation and Advocacy, ENGIE

- 10:35 – 10:50 Q&A session

- 10:50 – 11:00 European Biomethane Map 2024

Anastasiya Agapova, Technical and Project Officer, European Biogas Association

- 11:00 – 11:10 Infrastructure facilitating biomethane growth

Pierre Duvieusart, GIE Biomethane Area Sponsor

- 11:10 – 11:25 Q&A session

- 11:25 – 11:35 Concluding Keynote

Harmen Dekker, CEO, European Biogas Association

Air Liquide recently adopted an internal charter developed with WWF France and other experts, including the European Biogas Association, to enhance sustainable biomethane production. It focuses on four main pillars: contributing to the energy transition, supporting agroecological practices, maximising benefits for local ecosystems and promoting a circular economy, and preserving biodiversity while preventing environmental risks. We spoke with Arnaud De Veron, Sustainable Development Leader, to learn more.

The charter aims to increase awareness about the potential impacts of biomethane projects and to foster further collaboration with the ecosystem towards more efficient sustainability frameworks.

Could you briefly present Air Liquide’s Biogas Solutions?

Air Liquide, a world leader in gases, technologies and services for industry and healthcare, has developed competencies throughout the entire biomethane value chain. This includes biogas production from waste, its purification into biomethane, and its injection into gas grids or compression/liquefaction for storage and transportation to customers. Air Liquide currently operates 26 biomethane production units worldwide, with a yearly production capacity of approximately 1.8 TWh.

Could you elaborate on the inception of this collaboration project with WWF France and Air Liquide’s proactive approach to sustainable biomethane production?

In 2020, we carried out Life Cycle Assessments on two of our biomethane production units. The results highlighted the diversity of impacts of our sites. While every energy production asset can have both positive and negative environmental impacts, the multifunctionality of anaerobic digestion likely contributes to a broader range of externalities. This finding underscored the need for us to better understand and monitor the sustainability characteristics of our current operations and future projects, going beyond existing regulations that primarily focus on biomethane as an energy vector.

To reach this goal, we collaborated with WWF France to leverage their expertise in defining sustainability criteria to improve our projects and bring further legitimacy to our approach. Air Liquide Biogas Solutions and WWF France joined forces to design a first set of principles, criteria, and indicators to frame what sustainable biomethane production means with the support of some other stakeholders (consultants, academia and the European Biogas Association).

What are the main findings of this collaboration and the main commitments of Air Liquide?

The collaboration led to consider that the development of sustainable biomethane relies on 4 main principles:

- Contribute efficiently to energy transition

- Be a lever for agroecological practices

- Maximise benefits for local ecosystems and promote circular economy

- Preserve biodiversity and prevent environmental risks

The main findings are further detailed in a public synthesis that aims to increase the awareness of the potential impacts of biomethane projects and to engage further collaboration with the ecosystem toward more efficient sustainability frameworks.

Could you provide some specific examples of actions taken by Air Liquide?

Besides the public synthesis, the collaboration aimed to develop an internal charter for our investment committee to assess the sustainability of any new projects based on (i) clear and thorough criteria considered as “Sustainability Essentials” for selection purposes and (ii) key sustainability indicators combined into an overall “Sustainability Score” for comparison purposes.

For instance, this frames the followings:

- production projects should not incorporate food-and-feed crops (except intermediate crops)

- facilities are designed to minimise methane and ammonia losses

- biomethane carbon footprint reduction and energy return on investment maximisation are incentivised

- agroecological practices (e.g. diversification and chemicals minimisation for the intermediate crops) are promoted

What are the main limits and what could be the next steps?

First, I would emphasise that beyond this generic framework, the sustainability of each project depends on local conditions. Moreover, this internal charter must be seen as a humble contribution that will certainly evolve in the future and that needs to be discussed, enriched, and challenged by other stakeholders. In particular, biomethane projects are embedded within existing agricultural systems and the farmers are a crucial part of the equation. It will be necessary to engage more with them in the future.

We also need to collaborate more with the authorities to make sure that government incentives favour equally economic success and sustainability. We must seek systemic, impactful, and pragmatic measures and create a level playing field that promotes the most sustainable practices.

May 23, 2024 03:00 PM

ALFA’s webinar on Challenges and needs for the uptake of biogas in livestock farming in Europe will be the first of 6 webinars organized by the ALFA project and Sustainable Innovations. White Research will present a series of identified barriers, needs, and enabling factors to the uptake of biogas in livestock farming, based on European-wide surveys of experts and citizens. The European Biogas Association will present the current status of biogas in Europe and the benefits of enhancing its adoption. Attendees will also have the opportunity to share their experiences and voice their concerns about existing challenges and needs particular to their regional contexts.

More information and registration here

27-28 November 2024. Barcelona, Spain.

The pursuit of net-zero emissions by 2050 has propelled the demand for biogas and alternative fuels to unprecedented levels. The industry faces significant challenges as it strives to expand and innovate within this timeframe.

The conference sessions will delve into current policies and regulations, advancements in the transportation sector including maritime applications, geographical considerations, emerging opportunities in biogas, the journey towards reducing dependence on Russian gas, and more.

This two-day event will convene senior executives and experts across the entire value chain, providing a platform for collaboration and knowledge exchange for all stakeholders involved in anaerobic digestion of organic matter and renewable energy production through biogas.

More information and registration here.

12-14 June 2024. Pula, Croatia

Relevant experts from the public and private sector and high representatives of national and international institutions await you at the most important conference on renewable energy sources in this part of Europe. This conference is an ideal opportunity to obtain information and connect all relevant stakeholders in one place.

The three-day event through panels and lectures will cover numerous topics such as public policies in the RES sector, the development of all RES technologies (wind, sun, geothermal, biogas and biomass), agrosolar power plants, energy storage systems, grid development, hydrogen, environmental and nature protection, electromobility and other topics important for RES development.

More information and registration here.

Using manure from livestock farming for biogas production has positive environmental and economic impacts. These include reducing greenhouse gas (GHG) emissions by replacing fossil fuels, mitigating air, soil, and water pollution through improved manure management, and diversifying farmers’ income. In this article, we explore the strategies adopted through the ALFA project to achieve this objective and highlight the benefits of unlocking the biogas potential from livestock farmers. Additionally, we shed light on the social perception and acceptance.

Sustainable agriculture as driver of biogas production

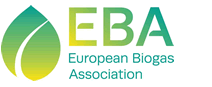

According to the European Biogas Association’s 2023 database, the agricultural sector significantly contributes to European biogas and biomethane production, with 67% of biogas and 64% of biomethane originating from agricultural plants. This shows the substantial role of agricultural feedstocks like manure, sequential crops, and other residues. The recently published Guidehouse report “Biogases towards 2040 and beyond: A realistic and resilient path to climate neutrality” calculates that by 2040, 82% of the biogases potential will be derived from agriculture, with 43% from sequential crops, 20% from agricultural residues, and 19% from animal manure. This indicates a continued integration between the agricultural sector and renewable gas production.

In that context, the ALFA project aims to harness the significant role of agriculture in the biogas sector by tapping into the potential of biogas production specifically from livestock farming. The goal is to promote wider uptake of renewable energy sources and increase the share of bioenergy as a flexible energy source, all while reducing emissions from untreated animal waste and supporting the creation of new jobs and the local economy.

The diverse frameworks and specificities of local biogas markets across Europe require an adaptable approach that goes beyond uniform strategies when supporting the scaleup and market uptake of biogas technologies.

Critical challenges for livestock farmers

During the initial phase of the ALFA project, partners assessed the current social, economic, and legal factors that hinder the use of anaerobic digestion (AD) technologies for on-farm biogas production. They concluded that the six target countries of the project have high potential to use livestock manure to enhance their biogas production. However, they still face specific barriers.

In Greece, unused biomass and a lack of biomethane commercialisation persist due to inadequate financial incentives for biogas projects. Farmers’ limited technical know-how and awareness of biogas benefits remain a challenge in Spain. Slovakia encounters logistical barriers especially in grid infrastructure, alongside insufficient public support, and regulatory clarity for biogas operations. Italy’s biogas growth is slowing down by complex authorisation procedures and social opposition. Belgian farmers find obtaining a permit to install a biogas plant difficult. In Denmark, farmers require assistance in both business and technical aspects.

A survey of 3,000 EU citizens revealed a limited understanding of biogas production from manure. While respondents generally have positive perceptions of its environmental and economic benefits, there are misconceptions, such as concerns about health impacts and the safety of production technology. Some also believe biogas production can worsen odours and lower property values nearby.

Local ecosystems: a core element of biogas production

To address this multitude of challenges, ALFA established regional hubs in six European countries (Belgium, Denmark, Greece, Spain, Italy, and Slovakia) early in 2022 and started engaging with local stakeholders to setup regional networks as an effective mechanism for engagement and cooperation with the local ecosystems. These networks were instrumental in conducting framework analyses of the biogas sector, identifying success stories and co-designing an inclusive and responsive local-needs-approach in all biogas project activities.

Based on in-depth interviews with successful biogas and biomethane implementations, ALFA hubs came up with valuable recommendations for prospective investors:

- Firstly, consider the operational and maintenance demands of running a biogas plant, factoring in initial design, operation, and maintenance plans to mitigate investment risks and secure biomass feedstock. Return on investment typically spans 6-7 years, varying by country.

- Before installation, conduct 4-5 manure analyses to accurately assess biogas potential. Also, the quality of liquid manure is easier to work with than thick manure, though this may vary depending on the specific case.

- Diversify feedstock and integrate renewable energy sources to broaden income streams. Prioritise biomethane plant implementation alongside biogas facilities for optimal outcomes.

- Given bureaucratic challenges, having project participants knowledgeable in authorisation and implementation processes proves advantageous, especially considering significant variations across countries and regions.

In addition to the above recommendations, ALFA also created decision support tools to provide actionable knowledge and science-based information to livestock farming for leveraging the potential of biogas and fostering a fruitful environment for ideas exchange, networking, and collaboration. These resources are available through the ALFA Engagement platform and include: the Livestock Biogas Library (with various materials, including articles), a Decision Support Tool (for assessing biogas projects in terms of profitability and environmental and social benefits), an interactive map with active Biogas Cases, an online repository named Knowledge Center with useful informative materials, and a Biogas Forum serving as an open environment for nurturing novel ideas and exchanging best practices.

The ALFA project is designed to act as a catalyst of biogas production by offering demand driven support for livestock farmers to take up biogas solutions, while also providing policymakers and stakeholders insightful information on biogas market dynamics. The project will complete its journey by providing science-based information to livestock farming decision makers for the potential of biogas in the form of policy recommendations. Additionally, it aims to raise awareness of the general public on misperceptions about biogas and bioenergy and contribute to the market uptake of biogas solutions in the livestock sector by producing an easy-to-use replication guide.

About the author

George Osei Owusu – Project and Technical Officer owusu@europeanbiogas.eu , ALFA Consortium konstas@qplan-intl.gr

George Osei Owusu started working as Technical and Project Officer at EBA. He is mainly involved in EU projects on biogas and biomethane, predominantly on market research and the application of biogas in some EU countries, such as GreenMeUp, ALFA and eQATOR. George has a background in Environmental Science with a master’s degree in environmental science and engineering from JUNIA, France.

Published on 3 May 2024.

Tuesday 14 May 2024, 14:30-15:45 CEST, Online

The cooperation between all energy related sectors, from production to end-users, is crucial to reach climate neutrality in 2050 EU’s objectives as well as intermediary 2040 target.

The webinar “Industry contribution to 2040 targets strategy through reinforced sector integration” organised by ENZA will shed light on the benefits of a multi-energy and sector-integrated systems (combining power, heat and other fuels) to deliver a cost-efficient energy transition and accelerate the integration of renewables into our energy system.

The event will also highlight opportunities for European industries to mitigate their CO2 emissions and contribute to Europe’s net-zero emissions target.

This event is part of the European Sustainable Energy Week.

9 – 11 October 2024. Bologna, Italy

Fueling Tomorrow is the event dedicated to the transformation of fuels and the use of new energy vectors in the transport sector and ‘hard-to-abate’ industries, in the context of ecological transition.

The event will focus on both traditional and innovative sources of energy supply, emphasising a transition path towards a more environmentally, economically and socially sustainable energy future.

The aim is to redefine the current energy landscape, combining traditional fuels, made more environmentally friendly through innovative refining processes, with cutting-edge solutions such as green gases (ranging from hydrogen to biomethane), electric.

Using biomethane to reach net-zero emissions in primary steel and dispatchable power

Biomethane as a renewable energy source can be used to reduce greenhouse gas emissions in various end use sectors. This study aims to provide insights on the abatement costs and potential of biomethane compared to other forms of renewable and low-carbon energy. It shows that biomethane can play a relevant role as a cost-effective abatement option irrespective of its sustainable production potential.

This report focuses on the abatement costs of biomethane to produce dispatchable electricity and to provide high temperature heat and carbon-rich feedstock to produce steel, as two relevant examples. Biomethane could perform well in ‘sweet spots’ in other end use sectors too. Modelling is required to obtain a more definite view on the merits of biomethane in all end use sectors.

Biomethane is produced with net-zero lifecycle emissions, if manure is used in the average feedstock mix, and no main crops. Using manure avoids methane emissions which offset the (limited) supply chain emissions from other feedstocks. The greenhouse gas emission performance of biomethane can be enhanced by applying negative emission measures. Biomethane can provide negative emissions in three ways: (1) carbon storage in the soil when growing biomass, (2) precombustion carbon capture in the production of biomethane and (3) post-combustion carbon capture when using it.

Production costs of biomethane could be €70 per MWh on average, noting that production in large installations is significantly cheaper than in smaller ones. This cost level equals a renewable hydrogen cost of just over €2 per kilogramme.

The marginal abatement cost curves presented as example case studies in this report show that biomethane is a cost-efficient abatement option in the production of dispatchable electricity and in primary steel production. The abatement potential of biomethane in both assessed sectors is capped by the supply potential that can be made available for consumption in these sectors.

In the electricity system, electricity from biomethane is the most cost-effective option to balance the electricity system in particular during ‘windless winter weeks’, making use of inexpensive storage in existing gas storages. In primary steel production, biomethane can be used in the DRI process, thereby replacing existing steel production that uses cokes coal. Most steel abatement options end up with remaining emissions. Biomethane combined with CCS is not only the most cost-effective option to achieve net zero emissions steel production, but beyond that it achieves climate positive steel.

The Biomethane Industrial Partnership (BIP), in collaboration with the Directorate-General for Energy (DG ENER), the European Biogas Association (EBA) and the European Renewable Gas Registry (ERGaR), will host the policy session “From waste to renewable energy: how biomethane can foster resilient energy communities” at the European Sustainable Energy Week (EUSEW) 2024.

Scheduled to take place on June 12th, from 16:30 to 18:00 CEST, both in Brussels and online, the session “From waste to renewable energy: how biomethane can foster resilient energy communities” will focus on the role of biomethane in fostering resilient and effective energy communities.

The session will explore how biomethane can be a local, green, and resilient energy source, highlighting its diverse benefits, from the efficient utilisation of waste-based feedstock to the production of organic fertilisers and the mitigation of CO2 emissions. Additionally, it will examine how building biomethane energy communities can enhance citizen engagement and local leadership, addressing social acceptance concerns and the importance of sector awareness.

Projections for biomethane production by 2040 will be presented, offering insights into future energy landscapes. Lastly, best practices for timely and constructive engagement with local communities will be shared, highlighting strategies to expedite the implementation of biomethane projects and achieve the objective of the energy transition.

The session will feature different perspectives from the EU institutions, academia, industry, energy cooperatives, and gas infrastructure association operators.

To register for our session, please start by registering for EUSEW 2024. After completing your registration, navigate to the “Programme” section on the EUSEW website. Select our session “From Waste to Renewable Energy: Biomethane and Renewable Energy Communities” scheduled for June 12th, from 16:30 to 18:00 CEST. Then, click on “Add to my agenda”.

Following the great success of the first edition, the event dedicated to biomethane is returning to Spain.

The Biomethane RNG Day II DÍA DEL BIOMETANO is organised by the Biomethane RNG Channel the first website entirely dedicated to biomethane, and will take place on May 23, 2024 , at the Alfonso XIII Hotel in Seville.

Market experts will take turns on stage, discussing the significant potential of biomethane in Spain, available technologies, and showcasing successful case studies from other countries.

According to the 2023 statistical report by the European Biogas Association, Spain ranks third in Europe with a biomethane production potential of 20 billion cubic meters per year by 2050

In 2023, biomethane production in Spain for injection into the gas network experienced a 38% increase compared to the same period in 2022.

The Biomethane RNGRNG Day agenda will cover a wide range of topics for reflection, welcoming all Day agenda will cover a wide range of topics for reflection, welcoming all those interested in learning more about this hot topic those interested in learning more about this hot topic!

Information and registration here.

Brussels 16/04/24: A new report by Guidehouse reveals that Europe (EU-27 + UK, Norway and Switzerland) could produce 111 bcm of biomethane by 2040. This amount represents over 30% of the EU gas consumption in 2022. As a renewable and domestically-produced source of gas, biomethane is gaining momentum and the industry is fast mobilising to speed up the decarbonisation of many sectors of the European economy.

Biogases will play an important role in the European Union’s (EU) ambition to achieve a net-zero future by 2050. Via the REPowerEU plan, the European Commission has set a target to produce 35 billion cubic metres (bcm) of biomethane annually in the EU by 2030, representing a ten-fold increase of biomethane production today.

Today, momentum is building to achieve the REPowerEU target of 35 bcm of biomethane and the industry is mobilising fast into an exponential growth of biomethane. Europe is today producing 4 bcm of biomethane (according to latest EBA consolidated data from 2022) thanks to newly built plants and upgrading of existing biogas units. Raw biogas production mainly used in combined heat and power plants is currently at 17 bcm.

The EU’s focus is now turning to 2040 as a mid-term milestone towards climate-neutrality. The European Commission is recommending a 90% greenhouse gas (GHG) emission savings target by 2040, relative to 1990 levels. This will require further action to decarbonise across all sectors of the economy. The accompanying Impact Assessment shows that even in a scenario with accelerated electrification across the economy, there will still be a substantial demand for gas, which can be progressively replaced by renewable gases, such as biomethane.

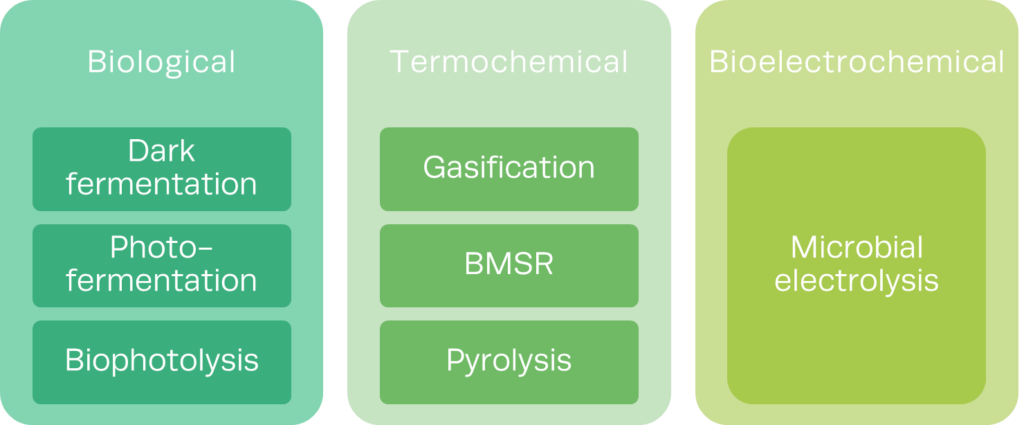

The 2040 biomethane potential for Europe estimated in Guidehouse report includes 75 bcm anaerobic digestion (AD) and 37 bcm thermal gasification. The biggest producers in 2040 are estimated to be Germany, France, Spain, Italy and Poland, as well as the UK.

The paper also provides a targeted update of the 2022 Gas for Climate study following the same assumptions and methodology, yet incorporating latest data and insights to review the potential estimates for 2030 and 2050. The latest analysis shows that up to 44 bcm of biomethane could be produced in Europe in 2030 and 165 bcm in 2050.

Additionally, to the biomethane potential assessment, the study gives further insights into novel feedstocks and technologies that can boost the potential for biomethane production. Realising those potentials will require a favourable and stable policy environment that gives certainty to stakeholders across the biomethane value chain, but with the right conditions, there is significant potential waiting to be unlocked.

Contact

Angela Sainz – EBA Communications Director sainz@europeanbiogas.eu

This paper provides a refresh of the 2022 Gas for Climate study, incorporating latest data and insights to update the potential estimates for 2030 and 2050, and turns the focus to 2040 to provide a realistic estimate of how the potential for biomethane production in Europe can continue to develop.

The updated estimate shows that up to 44 bcm of biomethane could be produced in Europe in 2030 and 165 bcm in 2050 (of which 40 bcm in 2030 and 150 bcm in 2050 are for the EU-27). The estimated biomethane production potentials in this study are broadly consistent with the 2022 Gas for Climate study, given that the underlying methodology and key assumptions have not fundamentally changed.

In 2040, Europe could produce 111 bcm biomethane, of which 101 bcm relates to the EU-27. This potential is made up of 74 bcm anaerobic digestion (67% of the total) and 37 bcm thermal gasification (33% of the total).

On top of this, additional potential could be unlocked from novel feedstocks such as crops grown on marginal or contaminated lands, seaweed and digestate, as well as through the application of novel technologies such as hydrothermal gasification and renewable methane. In addition, landfill gas can further increase the potential in the short to medium term. This paper provides qualitative insights on how each of these can play an important role in further contributing towards a sustainable biomethane production in 2040 and beyond.

This paper provides a scenario of what is possible when action is taken across Europe to mobilise available feedstock streams towards producing biomethane towards 2040 and beyond.

The further expansion of biogas production in Europe will see the generation of increasing amounts of digestate. Leveraging its significant advantages will yield benefits for farmers, local communities, and producers alike. The European Biogas Association is launching a comprehensive white paper exploring the potential of digestate in fostering healthy soils and advancing sustainable agricultural practices across Europe. Further work is also carried out via the FER-PLAY project, assessing multiple types of alternative fertilsers.

From reducing reliance on costly synthetic fertilisers to promoting effective soil management and restoration, digestate emerges as a key player in addressing mineral imbalances in soils and facilitating efficient carbon capture. Moreover, its utilisation aligns with ongoing developments in EU carbon farming policies, positioning it as a cornerstone in Europe’s transition to a greener, more sustainable agricultural sector.

What is digestate?

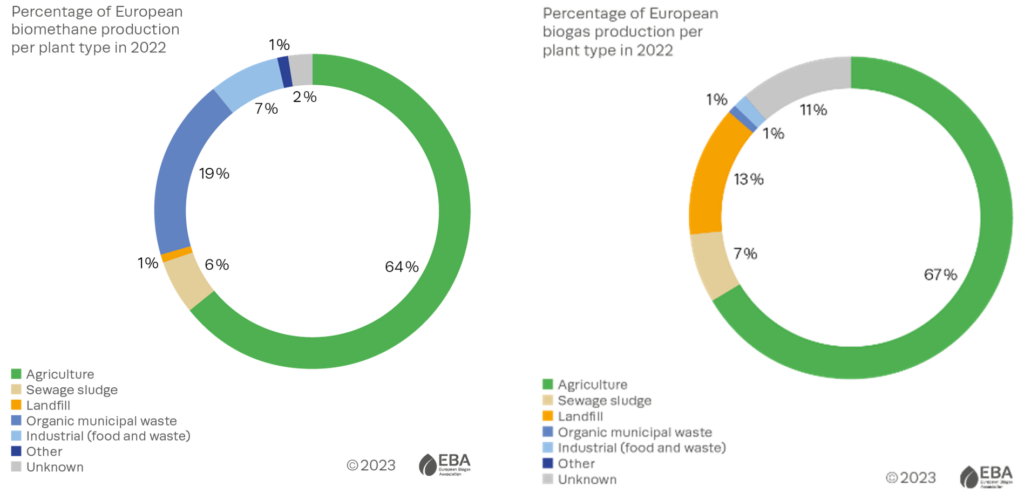

During the anaerobic digestion process, biogas is produced alongside another valuable stream, called digestate. While a portion of the organics from the raw feedstock is converted to biogas during the process, the mineral fraction remains largely intact in the digestate. This makes it an appealing organic-mineral fertiliser.

Raw feedstocks for anaerobic digestion are largely composed of biodegradable organic matter, poorly degradable or stable organic fraction and nutrients. First, about two thirds of the biodegradable organic matter is turned into biogas, heavily reducing its share in the digestate. Second, for the stable organic fraction, the same amount is present in the digestate and raw feedstock. This stable organic fraction is particularly beneficial for soils as it serves as precursor for humus material, thus improving the clay-humus complex of soils. Thirdly, as biogas is composed of methane and carbon dioxide, fertiliser elements (N,P,K) are preserved in the digestate. Moreover, some of these elements are transformed in the AD reactor to the benefit of plant growth. For example, the organic nitrogen in the substrate is partly mineralised into ammonium, a readily available source of nitrogen for plants.

Regulatory framework

Several legislations regulate the production, application, and marketing of digestate in the European Union. These policies encompass various aspects of digestate management, including its production processes, quality standards, application rates and environmental considerations. They often depend on the input used in the anaerobic digestion process. Policies governing digestate at EU level include the Waste Framework Directive, the Animal By-Products Regulation, the Fertilisers Regulation, and the Nitrates Directive and the Sewage Sludge Directive.

The framework for digestate at national level is complex and far from being harmonised across Member States. Individual member states may have their own specific regulations and guidelines pertaining to digestate management to ensure compliance with EU directives and to address local environmental and agricultural needs. The crucial aspect regarding digestate on a national scale is to have clear legislation providing legal certainty for all types of products and requirements that can be easily operationalised, thus avoiding red-tape. Additionally, providing an end-of-waste criteria for digestate at national level will have a positive impact on the public perception of digestate. As long as digestate is classified as waste, its value is diminished, hindering its broader acceptance and utilisation.

Regulatory barriers persist, limiting the application of digestate. For example, under the Nitrates directive, digestate from manure can only be applied under 170 kg of nitrogen per hectare per year, whereas synthetic fertilisers can be used above this limit to reach the nitrogen requirement for each specific crop. The lack of fertiliser or product status for digestate in national law is another major barrier as it leads to a restricted use of digestate or at least a depreciation of its value.

Positive impact on environment, climate, and soil health

Digestate has the potential to drive Europe’s agricultural sector towards regenerative practices and offers an attractive, sustainable alternative to commonly used synthetic fertilisers. The incorporation of digestate or its derivatives in EU agronomic practices contributes to the achievement of the strategic objectives for resource efficiency, the circular economy, and overall environmental stewardship. Utilising digestate enables a reduction in synthetic fertiliser usage as stipulated by the Farm to Fork strategy, has a positive impact on soil management and restoration, addresses mineral imbalances, and tackles the deficiency of organic matter in soils as outlined by the EU Soil Strategy. Moreover, it facilitates efficient carbon capture, aligning with ongoing developments in EU carbon farming policies.

About the authors

Lucile Sever – EBA Policy Officer sever@europeanbiogas.eu

Lucile Sever is the Policy Officer in charge of following the Circular Economy dossiers. She is dealing with legislation related to agriculture and environment and coordinates the EBA Working Group Circular Economy. Before joining the EBA in January 2023, Lucile worked for INRAE – the French Research Institute for Agriculture, Food and Environment – for three years implementing the advocacy strategy of the Institute and assisting researchers in the emergence of new EU projects. Previously, Lucile worked as a public and legal affairs officer in the Wine and Spirits sector.

Mieke Decorte – EBA Technical Director decorte@europeanbiogas.eu

Mieke Decorte is Technical Director at the European Biogas Association since 2021 while she joined the association in 2018. Mieke manages and coordinates the technical and project work within the EBA and supports EBA’s policy and communication work with technical knowledge and data. Her main responsibilities include coordinating EBA’s involvement in Horizon Europe and other programs and overseeing the EBA’s technical publications such as the EBA Statistical Report and the European biomethane map. Mieke has earned technical and market knowledge on the biogas sector with her work at the Flanders biogas association. She graduated in 2016 as a bioengineer at UGhent with a specialization in environmental technology.

Published on 11 April 2024

Brussels 11/04/24: The European Biogas Association (EBA) welcomes yesterday’s adoption of the European Parliament Report on the CountEmissions EU proposal, which is based on a well-to-wheel approach, but regrets the decision not to include a mechanism to account for renewable fuels in the scope of the CO2 Emission Performance Standards for Heavy-Duty Vehicles (HDVs) Regulation, as the text follows a tailpipe methodology that restrains the full accountability of biomethane in transport decarbonisation.

EBA supports the European Parliament work on the CountEmissions EU proposal, which aims to provide a uniform approach for measuring greenhouse gas (GHG) emissions from both passenger and goods transportation in the EU, utilising a well-to-wheel methodology[1].

The biogas industry equally acclaims the additional request of the European Parliament to task the European Commission with the development of a more comprehensive procedure for calculating all transport modes’ GHG emissions based on a life-cycle approach[2]. Such a science-based methodology would account for all emissions across the entire transport value chain, providing a level playing field for all decarbonisation solutions.

Despite this positive step, the adoption of the CO2 Emission Performance Standards for new HDVs, approved the same day, represents a missed opportunity to recognise biomethane’s contribution to transport decarbonisation. The tailpipe methodology[3] included in the proposal does not take into account the CO2 emissions savings achieved thanks to the use of renewable fuels, such as biomethane, contrary to the methodology considered in the CountEmissions EU proposal.

Biomethane is a solid and readily available solution to swiftly curb transport emissions, with the potential to even achieve negative emissions depending on the feedstock used in the production process. According to the EBA Statistical Report, 8.6 TWh of biomethane was used in transport in 2022, the equivalent of over 25,000 LNG trucks or 38,000 CNG trucks fuelled with biomethane annually.

“Regardless this setback, EBA acknowledges the disposition from some MEPs to assess more carefully the negative effects of the de facto ban to the registration of new Internal Combustion Engines (ICE) vehicles as of 2040 enshrined in the HDV’s adopted text”, said Anna Venturini, EBA Policy Manager. “EBA is ready to cooperate with the European Parliament and European Commission in the preparation of the upcoming 2027 revision of the text, so that the new proposal can have a technology-neutral approach allowing for all green solutions to speed-up transport decarbonisation.”

Contact

Anna Venturini– EBA Policy Manager venturini@europeanbiogas.eu

Ángela Sainz – EBA Communications Director sainz@europeanbiogas.eu +32 24 00 10 89

[1] Well-to-Wheel Methodology (WtW) integrates the whole process of fuel production and consumption.

[2] Life Cycle Assessment Methodology (LCA) includes emissions from the manufacturing, use, maintenance, and disposal of vehicles.

[3] Tailpipe methodology addresses only the driving phase of the vehicle.

12 June 2024. Dublin, Ireland

A platform for engagement and collaboration as Ireland’s biomethane industry moves forward at pace to meet the national decarbonisation target of 5.7TWh biomethane by 2030.

Join the Farmers, Developers, Planners, Financiers, Technologists, Researchers, Regulators and Administrators, who are keen realise the decarbonisation ambition, which will also optimise wider environmental and socio-economic benefits for agriculture, industry and communities.

Over 300 delegates, sponsor exhibits and one-to-one sessions.

Meet experienced practitioners, get their insights, and learn from their stories and know-how at this all island and international event. Raise your queries and express your viewpoint in the round table discussions.

More information and registration here.

We would like to invite you to join the European Biogas Association third Dig Deep! Webinar “Biogases towards 2040 and beyond: A realistic and resilient path to climate neutrality” on Tuesday 16 April 2024, from 10h to 11h30, to explore Biomethane potential by 2040 and beyond.

In February 2024, the European Commission unveiled its evaluation for an EU 2040 climate target aimed at cutting GHG emissions by 90%. This target reinforces EU’s commitment to combatting climate change and guides our trajectory beyond 2030, with the aim of attaining climate neutrality by 2050.

The webinar will be the occasion to unveil the 2040 Biomethane potential study, discover how biomethane stands out as a cost-effective solution for GHGs reduction in multiple sectors and engage in discussions on leveraging biogases to meet 2040 climate objectives, while navigating the path towards 2050.

Programme

- 10.00 – 10.10 Welcome and Introduction Harmen Dekker, CEO, EBA

- 10h10 – 10h20 Keynote Tom Howes, Advisor, Green Energy Transition & Energy Market Regulation DG ENER, European Commission

- 10h20 – 10h40 The biomethane potential in 2040 and beyond Gemma Toop & Sacha Alberici, Associate Directors, Guidehouse

- 10h40 – 10h55 Achieving the 2040 Climate Target Economically Daan Peters, Managing Director, Common Futures

- 10h55 – 11h25 Q&A Session Giulia Cancian, Secretary General, EBA

- 11h25 – 11h30 Conclusions Giulia Cancian, Secretary General, EBA

Last February 2024, the European Commission published its Communication outlining the ambitious Climate Target for 2040, which proposes a 90% reduction in greenhouse gas emissions. This target represents a clear and necessary response to the ongoing climate crisis. In light of this crucial development, we interviewed Ari Suomilammi, the Head of Renewable Gases at Gasum, to delve into the alignment of Gasum’s activities with the EC 2040 Climate Target. In this interview, we explore Gasum’s strategies, innovations, and contributions toward achieving the shared environmental objectives set forth by the European Commission.

1) Present Gasum in brief.

Gasum is a Nordic energy company. We offer cleaner energy and energy market services for businesses and cleaner fuel solutions for road and maritime transport. We help our customers reduce their own carbon footprint as well as that of their customers.

Our areas of expertise are natural gas, liquefied natural gas (LNG), biomethane, liquefied biomethane and electricity markets. We own and operate 21 biomethane plants (17 our own plants and 4 partner plants) and an extensive network of gas filling stations in the Nordic countries.

Sustainability is central to our values and the core of our strategy. Our objective is to increase the availability of low-carbon energy products to our customers, advance the circular economy and at the same time, to minimize the environmental impact of our own operations.

Our goal is to bring 7 TWh of renewable gas annually to the market by 2027 – this means a fourfold increase in four years. When we reach this goal, we will achieve a cumulative annual carbon dioxide saving of 1.8 million tons for our customers.

2) How does Gasum’s biogas production and biogenic CO2 utilisation align with the EC 2040 Climate Target, and what specific strategies or technologies are you employing for CO2 capture and utilisation in your biogas production process?

Gasum welcomes the European Commission’s Communication on the 2040 Climate target as it builds a long-term view of the renewable energy market and creates more security for further development of the biomethane market. We are currently investing significantly in conventional biomethane production, including new plant projects and expansion of existing capacity, and a longer-term view is welcomed in that sense.

We have conducted studies on how to utilize the biogenic CO2 from biogas production in Power-to-Gas production. Even though this would make the renewable gas volumes about 1,5 times higher, often the volumes are just too low, or the plant does not have sufficient power supply to make it financially viable. We are now focusing on CCU and CCS of biogenic CO2 as it seems to be the most viable solution at this point.

3) RFNBOs and e-methane are becoming increasingly interesting and can diversify biomethane production pathways. How is Gasum featuring this in its portfolio?

Gasum is including into its European wide sourcing portfolio also e-methane, which will play out an important and increasingly larger part of the renewable gas portfolio. In January 2024, Gasum and the leading Nordic Power-to-Gas developer Nordic Ren-Gas signed an e-methane offtake agreement, which will initially bring annually some160 GWh of renewable e-methane to Gasum’s portfolio starting in 2026. Moreover, the volumes with additional Nordic Ren-Gas projects are planned to grow up to 800 GWh by 2028 and there will also be other potential suppliers to Gasum’s portfolio in several European locations.

4) You are planning to bring 7 terawatt hours (TWh) of renewable gas per year to the market by 2027. How will you get there?

Gasum continuously upgrades and develops new biomethane production capacity throughout the Nordics. In addition to significant investments in our existing plants, we are developing five new biogas plants, each annually producing 133 GWh of liquefied biomethane. The projects in Götene and Borlänge are already in construction, whereas projects in Hörby, Sjöbo and Kalmar are progressing through their respective planning stages.

Collectively, our investments in the Nordics and sourcing renewable gas from our trusted partners will ensure that we will reach the annual 7 TWh target by 2027.

Sourcing of biomethane from various European countries also requires the transfer of Guarantees of Origins and Proofs of Sustainability between the national registries. This has proved quite complicated and sometimes it is unclear how that is to be done properly, especially when it comes to non-EU origin or liquefied gas. This needs to be improved and we are looking forward to the implementation of European wide Database for GoOs and PoSs. However, the target date for implementation in November 2024 seems to be unrealistic considering several unclarities in UDP. We strongly urge the EU Commission to speed up the process and engage stakeholders in the development process.

The European Biogas Association is launching a comprehensive white paper exploring the potential of digestate in fostering healthy soils and advancing sustainable agricultural practices across Europe.

The paper “Exploring digestate’s contribution to healthy soils” examines the multifaceted benefits of integrating digestate into EU agronomic practices. From reducing reliance on costly synthetic fertilisers to promoting effective soil management and restoration, digestate emerges as a key player in addressing mineral imbalances in soils and facilitating efficient carbon capture. Moreover, its utilisation aligns with ongoing developments in EU carbon farming policies, positioning it as a cornerstone in Europe’s transition to a greener, more sustainable agricultural sector.

The further expansion of biogas production in Europe will see the generation of increasing amounts of digestate. Leveraging its significant advantages will yield benefits for farmers, local communities, and producers alike.

The paper dives into the production of digestate, highlighting what happens in the digester and which types of digestate exist. It also investigates the agricultural properties and application of digestate, exploring its diverse uses across Europe and innovative application methods. Additionally, the paper examines the positive environmental, climatic, and soil health impacts associated with digestate, while also considering market strategies. Finally, it concludes with a regulatory framework analysis for digestate at EU and national level.

The European Biogas Association is launching a comprehensive white paper exploring the potential of digestate in fostering healthy soils and advancing sustainable agricultural practices across Europe.

The paper “Exploring digestate’s contribution to healthy soils” examines the multifaceted benefits of integrating digestate into EU agronomic practices. From reducing reliance on costly synthetic fertilisers to promoting effective soil management and restoration, digestate emerges as a key player in addressing mineral imbalances in soils and facilitating efficient carbon capture. Moreover, its utilisation aligns with ongoing developments in EU carbon farming policies, positioning it as a cornerstone in Europe’s transition to a greener, more sustainable agricultural sector.

The further expansion of biogas production in Europe will see the generation of increasing amounts of digestate. Leveraging its significant advantages will yield benefits for farmers, local communities, and producers alike.

The paper dives into the production of digestate, highlighting what happens in the digester and which types of digestate exist. It also investigates the agricultural properties and application of digestate, exploring its diverse uses across Europe and innovative application methods. Additionally, the paper examines the positive environmental, climatic, and soil health impacts associated with digestate, while also considering market strategies. Finally, it concludes with a regulatory framework analysis for digestate at EU and national level.

Brussels 22/03/24 – Yesterday, Harmen Dekker, the EBA CEO, was appointed member of the bureau of the Group of Experts on Gas of the United Nations Economic Commission for Europe (UNECE). This group integrated by eight experts helps UNECE’s member states to deliver on key political commitments such as the 2030 Agenda for Sustainable Development and the Paris Agreement on climate change.

Harmen Dekker, stated: “I am honoured to have been appointed as a member of the Group of Experts on Gas at the UNECE on behalf of EBA. Sustainable biogases have an important potential to supply all countries with a secure, affordable and renewable energy carrier. Biogas and biomethane are a resource addressing several societal issues and bringing circularity and environmental benefits. I look forward to cooperating with fellow experts to drive future developments”.

This expert group enables multi-stakeholder dialogue on sustainable and clean production, distribution, and consumption of gases. The group focuses on policy dialogue and exchange of information and experiences on gas issues of regional relevance, including the role of low carbon, decarbonized, and renewable gases.

The EBA Secretary General, Giulia Cancian, attended the 11th session of UNECE’s Group of Experts on Gas at the UN Nations Palace in Geneva, where she underlined the role of biomethane for the clean energy transition and its contribution towards security- affordability and sustainability.

Contact

Angela Sainz – EBA Communications Director sainz@europeanbiogas.eu

In the context of energy transition, the evolution of gas quality standards is essential. Standards provide regulatory coherence, enable increased product safety and quality, lower transaction costs and prices, and ultimately contribute to strengthen the EU’s single market.

Traditionally, gas standards on grid injection and transport use are defined by natural gas properties. Those standards are not always 100% suited to biomethane and may vary across countries. Differentiating between natural gas and biomethane and meticulously defining parameters such as oxygen, sulphur, and carbon dioxide will facilitate biomethane uptake and cross-border trade in the coming years, enabling the sector to deploy 35 bcm by 2030.

A full analysis on the specifications of different standards related to biomethane was carried out in the framework of the GreenMeUp project. The report will be made available shortly and this article summarises its key conclusions. The study also explores the guarantees of origin and standards related to digestates as an end-use product of biomethane.

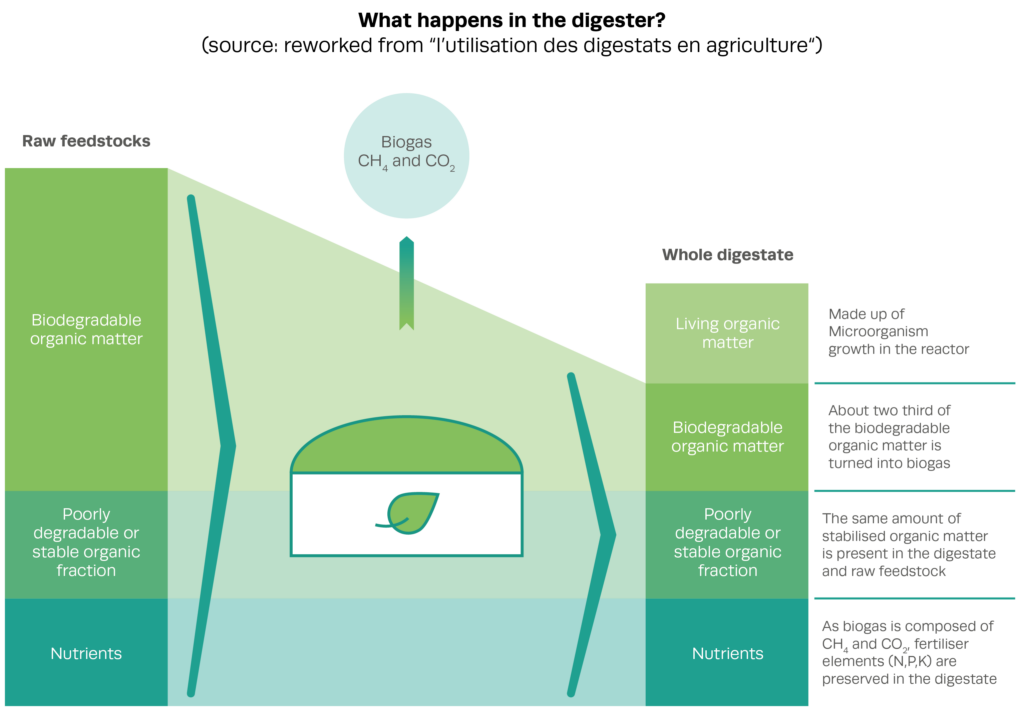

Gas Quality standard – the oxygen problem

The creation of gas quality standards EN 16726 by CEN (European Committee for Standardisation), exemplifies the collaborative effort towards regulatory alignment and market integration. The standard aims to enhance the interoperability of gas systems across EU member states by establishing technical rules such as gas pressure equipment and operation.

However, challenges persist in achieving uniformity across various countries. This is because the standard is voluntary, and countries can choose different standards if they wish (and often do). The omission of parameters like the Wobbe Index and discrepancies in permissible oxygen levels in the grid, highlight areas of contention for renewables, such as biomethane, from one country to another. For example, in Denmark, the legislation limits oxygen levels for biomethane injected into the grid to 0.5% mol/mol at entry points and transit and 0.1% at storage points. Italy has an oxygen limit up to 0.6% mol/mol for biomethane injected into the gas grid. Whiles France has lower tolerance of 0.001% mol/mol on hourly basis.

Controlling oxygen levels in the gas grid is important to avoid corrosion in both underground and above-ground facilities, as well as avoiding the formation of “black powder” in high-pressure grids. There are also risks of combustion, change in gas quality due to reaction and oxidation and possible microbial growth in the gas storage environment. But applying different level requirements creates variations in the gas quality and hampers cross-border trade of biomethane.

Increased harmonisation is expected thanks to the revised version of the standard (to be published in 2025) by incorporating normative recommendations for oxygen requirements, Wobbe Index and review the parameters present in the current standard, including hydrogen content and adapted minimum value for relative density, sulphur, and methane number.

Making biomethane the standard

While standard EN16726 defines gas quality standards for natural gas, EN1623-1 and EN1623-2 focus on injection, integration and safe utilisation of biomethane into the natural gas grid and for use in transport. It’s essential to recognise that biomethane possesses unique characteristics that may not be fully addressed by existing standards designed primarily for natural gas. Siloxanes, terpenes, amines, and other components specific to biomethane present distinct challenges that demand specialised attention, which is what both the EN16723 -1 and EN16723-2 cover to ensure a smooth uptake of biomethane.

But then again, oxygen requirements remain the biggest challenge coupled with the different requirements existing for the Wobbe Index, the calorific values and relative density of biomethane. Currently there is a working group collecting information for the revision of both EN 16723-1 and EN 16723-2 standards and will hopefully come with a different approach to address such discrepancies and enhance the easy integration of biomethane into the grid and the overall energy mix towards the deffossilissation of our economy and the achievement of climate-neutrality.

About the author

George Osei Owusu – Project and Technical Officer owusu@europeanbiogas.eu

George Osei Owusu started working as Technical and Project Officer at EBA. He is mainly involved in EU projects on biogas and biomethane, predominantly on market research and the application of biogas in some EU countries, such as GreenMeUp, ALFA and eQATOR. George has a background in Environmental Science with a master’s degree in environmental science and engineering from JUNIA, France.

Published on 13 March 2024

18 April 2024, Brussels

Back in March 2020, the European Commission announced its intention to develop an integrated nutrient management strategy in the Circular Economy Action Plan, “with a view to ensuring more sustainable application of nutrients and stimulating the markets for recovered nutrients”. Later on in 2021, the Communication on Sustainable Carbon Cycles was adopted, promoting green business models which take up sustainable practices, including the recycling of carbon from waste streams.

Against this background, the goal of the seminar is to discuss the drivers and barriers (from the technical, economic, social, legislative and environmental point of view) for the uptake of circular fertilisers in the market from producers’ perspective.

Programme and registration are available here.

We would like to invite you to join the next European Biogas Association Dig Deep! Webinar “Understanding Digestate: Nutrient Cycle, Soil Quality, Energy Resilience” on Wednesday 27 March from 10h to 11h30 CET, to explore the benefits of biogas digestate and the necessary steps to unleash its potential.

The use of digestate as organic fertiliser facilitates nutrient recycling and preserves soil health. Indeed, it contains nutrients, organic matter, and provides many benefits to crops and soil that could be further valorised.

Additionally, the development of a supply of alternative fertilisers reduces dependency on fossil fertilisers and their volatile prices, as well as impact on our food security.

However, the regulatory framework to facilitate digestate uptake differs between EU Member States. EBA will present during the webinar the results of an assessment to find common policy recommendations and regulatory incentives to ensure market access for a product that is sustainably and locally produced from waste valorisation.

Programme

- 10.00 – 10.05 Welcome Giulia Cancian, Secretary General, EBA

- 10h05 – 10h20 Fertilising Products Regulation Jeremy Pinte, Policy officer for fertilising products and chemicals, DG GROW, European Commission

- 10h20 – 10h35 Exploring Digestate’s contribution to healthy soils Mieke Decorte, Technical Director, EBA

- 10h35– 10h55 Mapping Digestate policy: Challenges and opportunities Lucile Sever, Policy Officer, EBA

- 10h55– 11h05 Experience with the FPR Certification for Biogas Residues Ildikó Varga, Expert Biostimulant Specialist, CerTrust

- 11h05 – 11h30 Q&A session and wrap up Giulia Cancian, Secretary General, EBA

Injecting biomethane in gas grids today can be a cumbersome process in many European countries. This hinders market access for the main renewable gas available today. However, the current status is set to change thanks to the new Hydrogen and Decarbonised Gas Package. If implemented correctly, the new set of measures will soon remove barriers to injection and unlock access to markets.

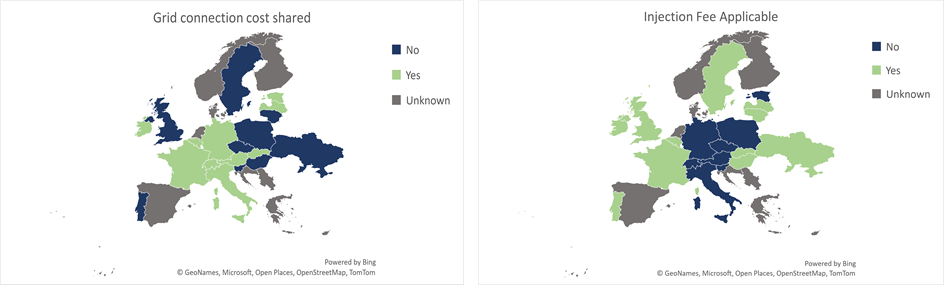

The European Biogas Association (EBA), within the framework of the GreenMeUp project, has evaluated regulations regarding grid connection cost sharing, gas quality, metering systems, and injection fees in 28 European countries analysed to understand what it takes today to move biomethane from the plants to the gas pipelines.

Greening gas grids with biomethane

Biomethane plants can connect to either a grid or operate independently. According to the EBA’s database for 2022, 75% of biomethane plants today are connected to the grid (58% to distribution and 17% to transmission grids). Multiple factors are significantly impacting the injection of biomethane into the gas grid, including enabling legislative frameworks, gas quality standards, the application of injection fees, or the negotiation of cost-sharing agreements between grid operators and biomethane producers.