Biohydrogen’s take into the net-zero equation

Biogases, including biohydrogen, are emerging as key players in the search for sustainable energy solutions. They can help decarbonise energy-intensive manufacturing processes, transportation and other sectors in need for defossilisation. An increasing number of innovators, researchers and industry experts is testing the solutions that biohydrogen can bring into the net-zero equation.

This form of green hydrogen is produced from biological feedstocks. The unique advantage of using biohydrogen technologies as renewable energy carriers is the achievement of negative emissions. This happens when more CO2 is being taken out of the atmosphere than added into it. As biohydrogen technologies continue to evolve, their transformative potential becomes more and more apparent, paving the way for a more sustainable and resilient energy future.

Biohydrogen production in the European biogas industry

The European biogas sector has been exponentially growing, with over 20,000 plants generating 223 TWh of energy in 2022. The industry is at an important turning point, transitioning towards biomethane production. In fact, the future energy mix will be formed by a co-existence of renewable gases, where biogas, biomethane and hydrogen have complementary roles. Biohydrogen production from biogas can further increase the versatility and flexibility of biogas plants, by diversifying the energy products and thus potential off-takers of anaerobic digestion plants.

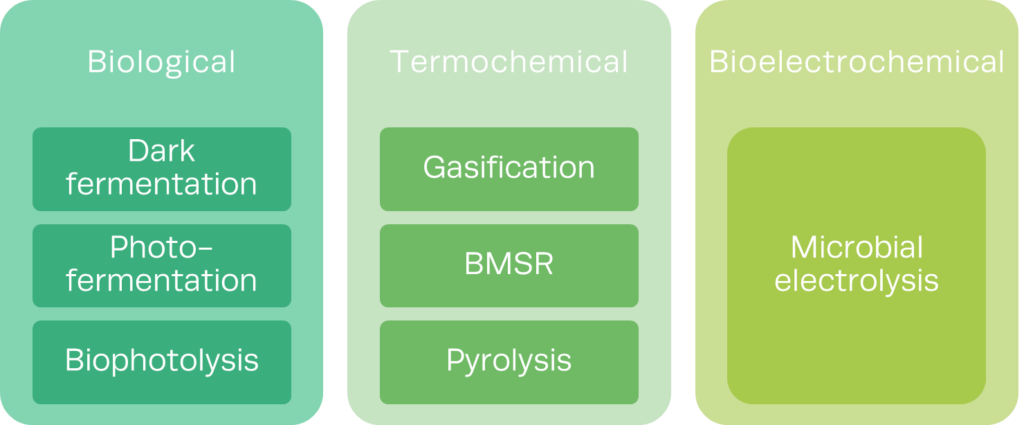

Biohydrogen refers to hydrogen obtained from biogenic sources. It can be produced from biogas, but also from a range of other production routes (Figure 1).

The European Biogas Association (EBA) is involved in TITAN, a R&D project exploring an innovative biohydrogen production technology. TITAN involves the direct conversion of biogas, by simultaneous biogas cracking and carbon dioxide dry reforming, to obtain biohydrogen and solid carbon materials. The project addresses the unique needs of small, remote, or unsubsidised biogas plants, offering an alternative path to valorise biogas efficiently and in a cost-competitive way.

Technologies that directly convert biogas into biohydrogen, such as the TITAN technology, find relevance in market segments or areas where grid connections are costly, making it ideal for plants far from the gas network. As financial incentives for electricity-only biogas plants in some areas are being phased-out, these technologies step in as a viable option, ensuring a more efficient and diversified renewable gas production with biohydrogen. They also hold promise in areas with hydrogen and carbon-intensive industries, becoming a strategic choice for existing plants in need for decarbonisation in synergy within local markets. Biohydrogen particularly stands out in rural areas, as a locally sourced green energy solution, reducing costs and issues associated with hydrogen transport. Finally, in the context of broader energy mix scenarios, biohydrogen from biogas facilitates allows the simultaneous deployment of complementary energy solutions, aligning with the EU’s decarbonisation goals.

Bio-hydrogen: a game changer for green industries

In 2020, Europe’s hydrogen demand hit 8.7 Mt. Most of the hydrogen demand went to refineries and ammonia industries (49% and 31% respectively), while the chemical industry used 13% of the total hydrogen demand. From 2015 to 2050, the Clean Hydrogen Monitor estimates a sevenfold rise in hydrogen demand. By 2030, industrial projects plan a total consumption of 5.2 Mt hydrogen/year. These energy intensive sectors, however, are slowly shifting from fossil to green and biohydrogen utilisation, aligning with emission reduction goals. In this context, biohydrogen emerges as a game-changer energy source and carbon removal renewable gas.

The industry of iron and steel is a prime example of an industrial sector in urgent need for defossilisation. Renewable electricity alone is not sufficient to decarbonise the sector and the use of biohydrogen can effectively double the carbon credit of hydrogen-based steelmaking routes. Likewise, in the chemical industry, the use of biohydrogen as feedstock can stir up steam methane reforming (SMR)-based ammonia production. The use of bio-hydrogen in that process can substantially reduce associated carbon emissions and facilitate the production of carbon-negative ammonia with carbon capture and storage (CCS) technologies. The ethylene synthesis process, reliant on hydrogen-based heat generation, sees a remarkable reduction of its carbon footprint using carbon-negative biohydrogen.

On top of the industrial applications, hydrogen-carrier molecules such as biomethane, biomethanol and bioammonia offer a solution to transport hydrogen cost effectively. Biomethane and hydrogen integration in Europe’s energy mix show promising synergies in terms of seasonal storage and grid utilisation. Bioammonia serves as a direct and biologically produced hydrogen carrier, offering versatility in energy applications. Similarly, biomethanol appears as an eco-friendly fuel for hard-to-decarbonise transport, presenting safety advantages and potential for diverse downstream products.

A promising solution for Europe’s renewable energy landscape

Biohydrogen technologies provide promising solutions for Europe’s renewable energy landscape. Especially biogas market segments facing challenges, such as large distance to gas network or the phasing out of incentives for electricity-only biogas plants, will benefit from these technologies. Biohydrogen not only facilitates industrial decarbonisation but also aligns with broader energy mix scenarios, contributing to the EU’s decarbonisation goals. As biohydrogen continues to advance, the next frontier in renewable energy unfolds, promising a more resilient and eco-friendly future.

About the author

Marina Pasteris – Technical and Project Manager: Marina Pasteris joined EBA in October 2021. Her role involves providing technical expertise and data to support EBA’s policy and communication activities. Her main responsibilities include the analysis of biogas and biomethane markets data for EBA publications, overseeing EBA activities on EU-funded projects and in areas such as biohydrogen, biogenic CO2, circular economy and digestate.

Published on 24/01/2024